Test question: Does Canada catch more big fish than anywhere else in the world? Or, on the contrary, does he prefer to go after small fish, as we often hear?

Posted at 6:30 a.m.

As you understand, I’m talking about the success rate of the Canada Revenue Authority in its battle against tax evasion, tax evasion, and even fraud. To find out the answer to the test, follow my boat.

The Parliamentary Budget Officer (PBO) has just released a study titled “International Comparison of Canada Revenue Agency Performance”. And by digging in, we learn a lot about phishing in Canada and major countries.

First, let’s look at a picture of the Canadian hunting. In 2019, Revenue Canada agents made 3.8 million checks, with which they returned $17 billion. The money comes from personal income tax and corporate income tax, plus goods and services tax or regional sales tax (HST).

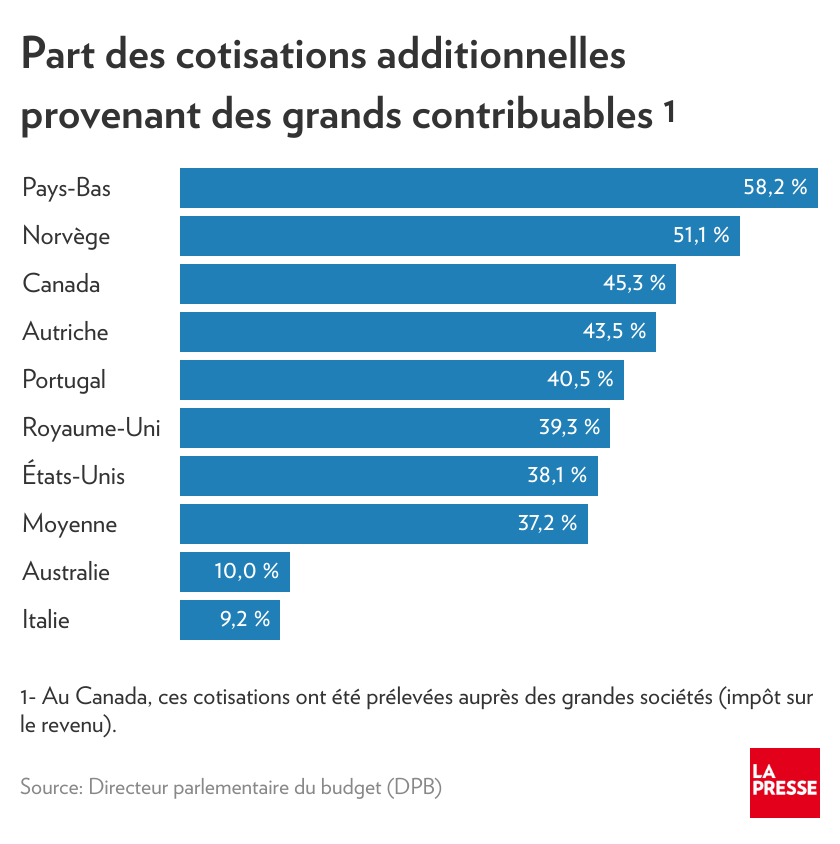

And what percentage of the 17 billion comes from the big fish? Answer: 45% or 7.7 billion. By big fish I mean big corporate income tax records.

I feel like you’re thinking, dear readers, but wait before drawing your conclusions. Yes, so small fish account for 55% of your tax refund (1), but it should be noted that larger fish are much less numerous. In fact, their small number causes Revenue Canada to perform only 3,200 audits per year, or 0.1% of the 3.8 million annual audits.

In other words, the Canada Revenue Authority recovers 45% of “extensions” with 0.1% of its files. There is no worse naval expedition, so to speak!

And in other places? Canada compares well in this regard, according to the PBO numbers.

Large fish recoveries represent 39.3% of the total in the UK, 38.1% in the US and only 10% in Australia. In sum, Canada, at 45%, is above the country average calculated by the Balance Sheet Office (PBO) of 37.2%.

Another way to judge Revenue Canada’s work is to calculate the additional rate of viscera fish, according to their size, so to speak.

In 2019, Revenue Canada collected $377 billion from taxpayers’ pockets, whether through individual and corporate income taxes or sales taxes. According to the PBO, 4.5% of that is recovered after audit, or $17 billion, which is what I call the incremental rate of fish fortification.

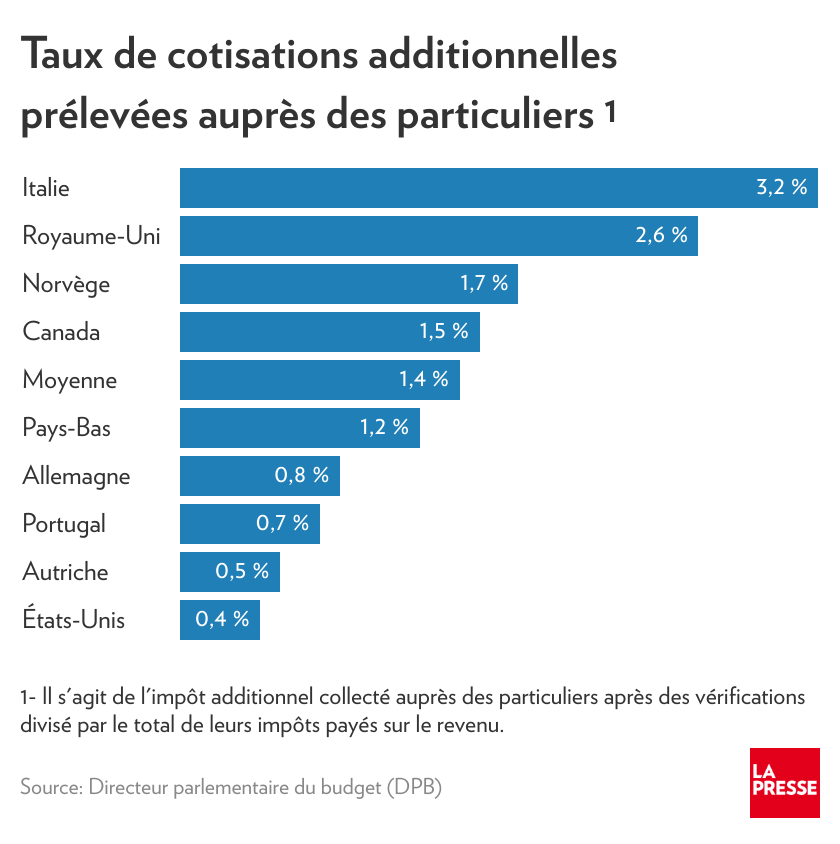

How about the lonely big fish? In 2019, the additional discharge rate was much higher, at 10.5% ($7.7 billion on $75 billion in income tax). In comparison, this rate is 1.5% for small fish (individuals).

Elsewhere in the world? For small fish, the recovery rate in the nine countries compared is 1.4% of all income taxes, according to data available from the PBO. At 1.5%, Canada is like average.

In the United States, where the agency has been underfunded for years, the rate is 0.4% for small marine invertebrates, much lower than in Canada. In Italy, where tax defaults are well documented, the rate is the highest at 3.1%.

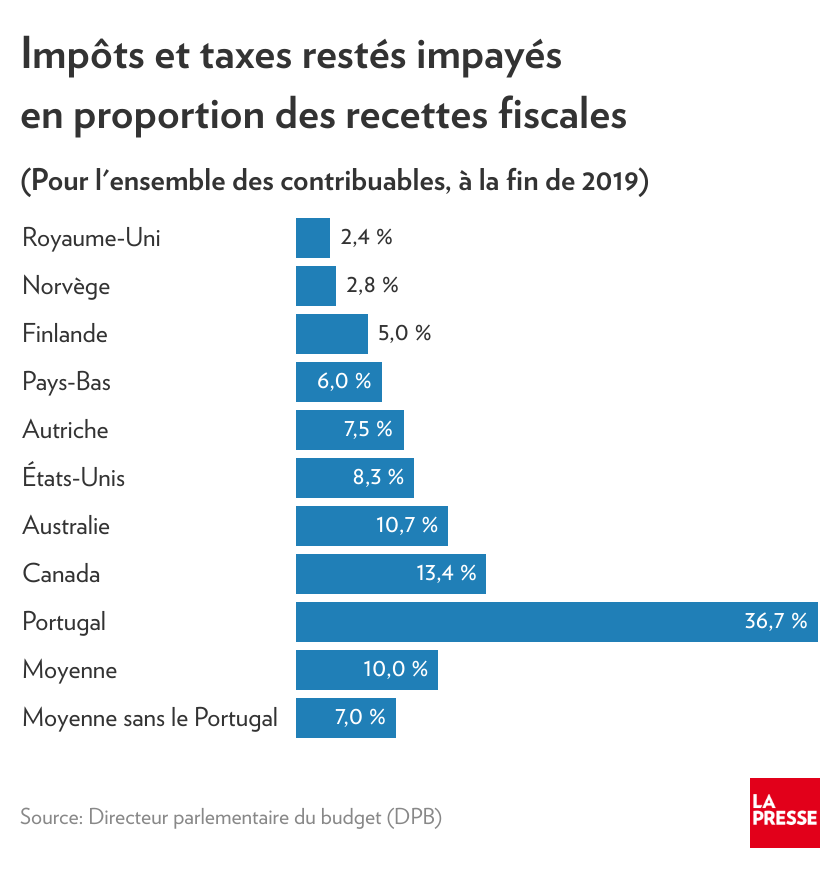

However, these findings do not make Canada a typical fisherman, far from it. On the other hand, the Canada Revenue Authority appears to have more civil servants than its peers elsewhere in the world. On the other hand, agency has a higher percentage of unpaid accounts.

According to a PBO analysis, arrears made up 13.4% of revenue collected at the end of 2019 in Canada, six times more than countries like the UK or Norway. Portugal, which is an exception with 36% of unpaid accounts, boosts the average.

According to the PBO, it is possible that “Tax Canada would prefer not to actively prosecute certain types of taxpayers.”

Another mixed point: the weight of the agency’s expenses. In Revenue Canada, for every dollar of operating expenses—essentially salaries—the revenue collected in taxpayers’ pockets is about $74. Elsewhere, we have managed to raise more, for example $117 in Australia, $135 in the UK and $163 in Norway.

However, this situation can be partially explained by the fact that Canada’s overall tax bill is generally lower than in comparable countries (19.8% of GDP vs. 32.2% in Norway, 28.3% in the UK, and 14.5% in the United States). United). ). In other words, civil servants also collect less because our tax rates are lower.

International comparisons of different systems are very difficult. For example, the PBO analysis of Canada, based on central government data from the International Monetary Fund (IMF), excludes data from the government of Quebec, due to its separate tax system. Thus, only income paid by Quebec residents to the federal government, in particular, is included.

So we should view these comparisons as an order of magnitude, which still provides a good overview of trends.

1- The 55% tax refund includes revenue recovered from GST and HST. Quebec was excluded from the study accounts due to its distinct tax system.

“Alcohol scholar. Twitter lover. Zombieaholic. Hipster-friendly coffee fanatic.”