Fortunately – and unlike in many other countries – bank failures are rare in Canada, where recent bank failures date back more than 25 years. However, it was already more frequent when 43 financial institutions closed their doors between 1967 and 1996. Fortunately, the deposits of nearly two million people affected by these bankruptcies were protected by the Canada Deposit Insurance Corporation (CDIC). In these times of economic uncertainty, it’s reassuring to know that your savings are safe. Here is how SADC, for nearly 55 years, has continued to monitor what is dear to you.

Posted at 7:30 am

XTRA is a division that collects promotional content produced by or for advertisers.

Protecting Canadians’ savings

CDIC is a Federal Crown company founded in 1967, after a year marked by a financial crisis and a loss of depositor confidence, exposing the fragility of the financial system.

By protecting the hard-earned and trusted funds of member institutions, CDIC contributes to the stability of the Canadian financial system.

Leah Anderson, President and CEO of CDIC

Today, CDIC protects more than $1 trillion in deposits — $1 trillion — and has more than 80 member institutions. The organization does not receive any public funds and instead finances its activities by collecting premiums from its members i.e. banks, federal credit unions, credit and loan companies.

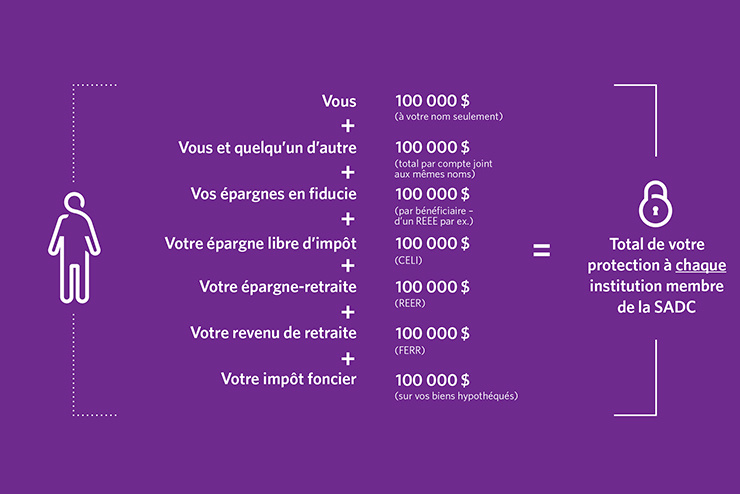

Automatically secured deposits of up to $100,000 per denomination

At each member institution, funds in a savings account, checking account, foreign currency deposits (in US dollars and others), guaranteed investment certificate (GIC) or other term deposits are automatically protected up to $100,000 in each of the following categories:

To take into account Canadians’ new saving habits, effective April 20, 2022, protections for trusted deposits will be strengthened and new categories of coverage will be added, including Registered Disability Savings Plans (RDSP).

However, your money invested in mutual funds, stocks, bonds, exchange-traded funds (ETFs), and/or cryptocurrencies does not benefit from any CDIC protection. In Quebec, some of these assets may be protected by programs other than those offered by SADC.

What will happen if your organization encounters financial difficulties?

The government institution has several tools at its disposal to restore the situation, such as selling the shares or assets of the financial institution, organizing the merger of the latter with another, or carrying out restructuring, while ensuring the continuity of basic financial services.

If a member financial institution closes its doors, CDIC will automatically repay the insured deposit amount (principal and interest) within a few days, in most cases. You won’t have to do anything after that.

2022 Resolution: Refining Financial Literacy

CDIC therefore encourages you to take advantage of the new year to take charge of your financial education by visiting the CDIC website (sadc.ca). You work hard to make your money, and throughout the year you will have to make decisions about how to use it.

By learning more about the Canadian financial system and the protection mechanisms available to you, you increase your ability to make informed decisions about your personal finances.

“Alcohol scholar. Twitter lover. Zombieaholic. Hipster-friendly coffee fanatic.”