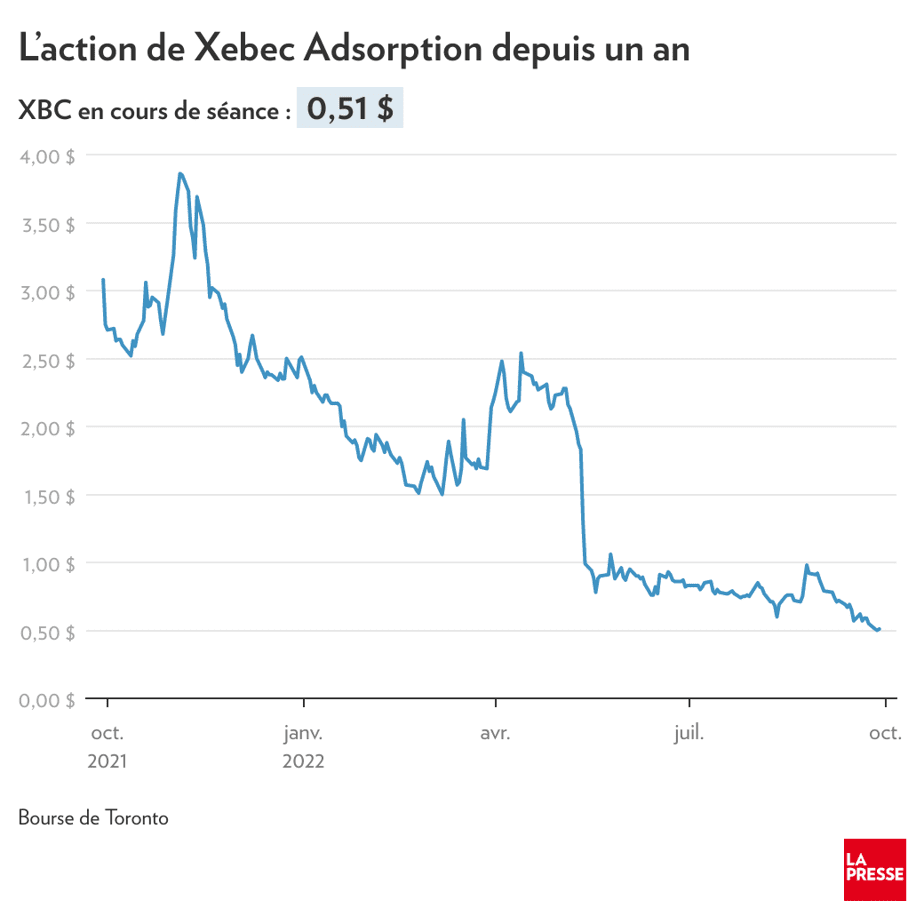

The listed company Xebec Adsorption, a solution provider for renewable gas producers, protects itself from its creditors.

Posted at 12:26 PM

In a press release, it announced Thursday morning that it is today filing an application for a preliminary injunction with the Supreme Court under the Corporate Creditors Arrangement Act (“CCAA”) and will seek recognition of the order in the United States under Chapter 15 Bankruptcy Code.

The goal is to suspend creditors’ resources to try to recover the company financially while it solicits investments or buyers for its assets, a process that must be approved by a court in time and place.

Xebec is advised by Osler, Hoskin & Harcourt, McDonald Hopkins and National Bank Financial.

Founded in 1967 and incorporated in Quebec, Xebec has 9 factories, 17 clean technology service centers and 5 sales offices on 4 continents. It employed 670 people as of June 30.

Its largest shareholder is Caisse de dépôt with just over 10.9 million shares, or 7.05% of the shares outstanding, as of December 31, 2021. Xebec’s senior management and directors collectively owned 12, 7 million shares, or 8.23% of the total.

More specifically, Xebec specializes in carbon capture technologies as well as hydrogen production, renewable natural gas, oxygen and nitrogen. In 2021, its annual revenue was 126 million.

As recently as March, Xebec was getting investors excited after signing a memorandum of understanding with a US client on a potential order worth over $100 million. The company then talked about nearly tripling its revenue in two years.

In terms of profitability, it was less impressive. Financial analysts reported a weak profit quarter on quarter.

Warning signs

The financial data for the second quarter, released on August 10, contained some bad news.

In July 2022, Xebec announced a reduction of its North American workforce by about 13%. Then, in the same month, the company entered into a residence agreement with the National Bank to amend the existing credit agreement after Xebec failed to meet the maximum ratio of total liabilities to tangible net worth under the credit facility. The credit facility contained in the residency agreement is available until September 30, 2022. On August 10, 2022, the outstanding amount of the credit facility was $25.3 million.

“Subtly charming problem solver. Extreme tv enthusiast. Web scholar. Evil beer expert. Music nerd. Food junkie.”