The unaffordable housing rate is 25.5% in British Columbia and 24.2% in Ontario. The Canadian rate is 20.9%.

” This is largely due to higher rates of unaffordable housing in the large, high-rent urban centers of Toronto (30.5%) and Vancouver (29.8%), both CMAs with the highest rates of unaffordable housing. »

tenants Downtown Toronto (45.2%), Vancouver (44.8%), and Montreal (44.2%) saw slightly lower rates of unaffordability in 2021. Meanwhile, homeowners were Downtown Toronto (36.2%), Vancouver (33.4%) and Montreal (30.9%) had the highest rates of unaffordable housing nationwide

explains Statistics Canada.

On the other hand, the rate of unaffordable housing decreases among the low-income tenants, mainly due to temporary income support.

The different impact of temporary COVID-19 benefits on occupant incomes—whether rented or owned—was a major factor in the differences in the magnitude of improvements in housing affordability for each group, from 2016 to 2021.

explains Statistics Canada.

Families that spend 30% or more of their income on housing costs are considered unaffordable.

source : Statistics Canada

With the last temporary benefits related to COVID-19 being phased out in early 2022 and inflation at its highest rate in 40 years, especially on the necessities of life, additional pressures could be placed on families already struggling to make ends meet.

adds Statistics Canada.

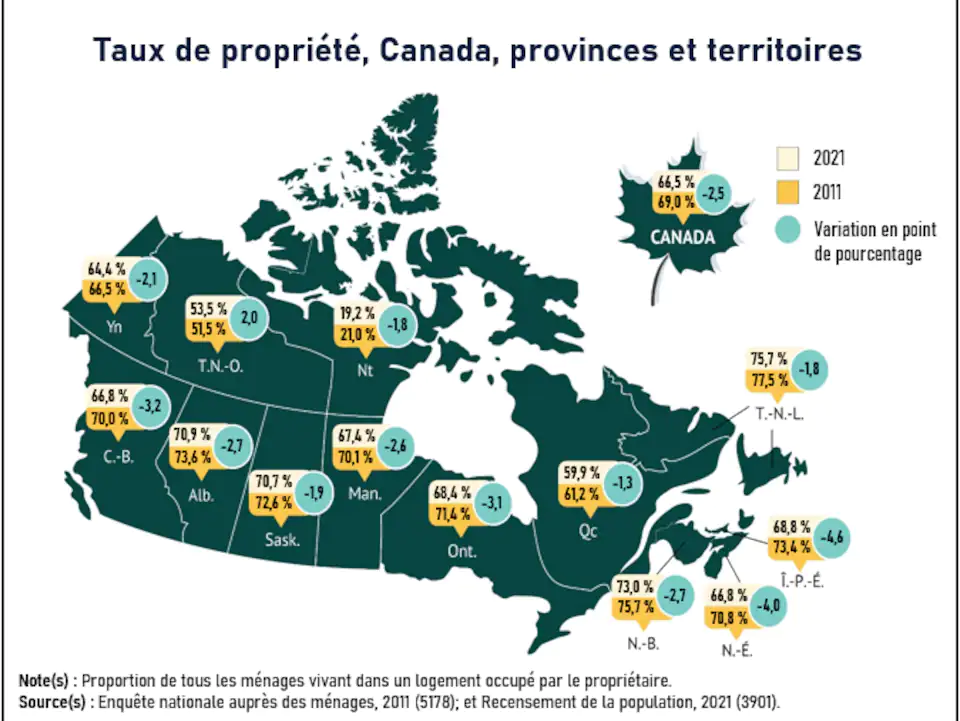

On the other hand, Canada’s home ownership rate is declining, reaching 66.5%, after peaking at 69% in 2011.

More young Canadians are concerned about their ability to afford housing

As part of the survey titled Canadian society picture

conducted this spring, about half of Canadians said they had modified their spending habits and lifestyle due to inflation. They searched for discounts and promotions (50%) and purchased cheaper alternatives, brands or items (47%).

Meanwhile, young Canadians aged 15-29 (53%) and 30-39 (39%) were the most likely to be seriously concerned about their affordability.

adds Statistics Canada.

Impact of higher interest rates on millennials

According to the 2021 Census, millennial homeowners with a mortgage paid an average of $2,124 a month in May 2021. The Bank of Canada raised interest rates by one percentage point in July 2022. So renewing or taking out a mortgage for millennials would cost On average, 12% more, or $2,378 per month. This amount could rise to $2,648 if interest rates increase by 2 percentage points, and to $2,934 (+38%) if interest rates increase by 3 percentage points.

source : Statistics Canada

On the other hand, as the country’s indigenous population continues to grow, according to the latest data from Census Canada for 2021, also released on Wednesday, First Nations, Inuit and Métis residents are increasingly likely to experience housing problems.

“Alcohol scholar. Twitter lover. Zombieaholic. Hipster-friendly coffee fanatic.”