Posted at 7:00 am

He was nicknamed “Little Napoleon on Rue Saint-François-Xavier”, where the Montreal Stock Exchange was located, of which he was president from 1907 to 1909.

It was finance magicianThe Money Wizard, according to an English-language publication from the same period.

This led to the role of XXe Century is Canada’s largest brokerage house, which bore his title.

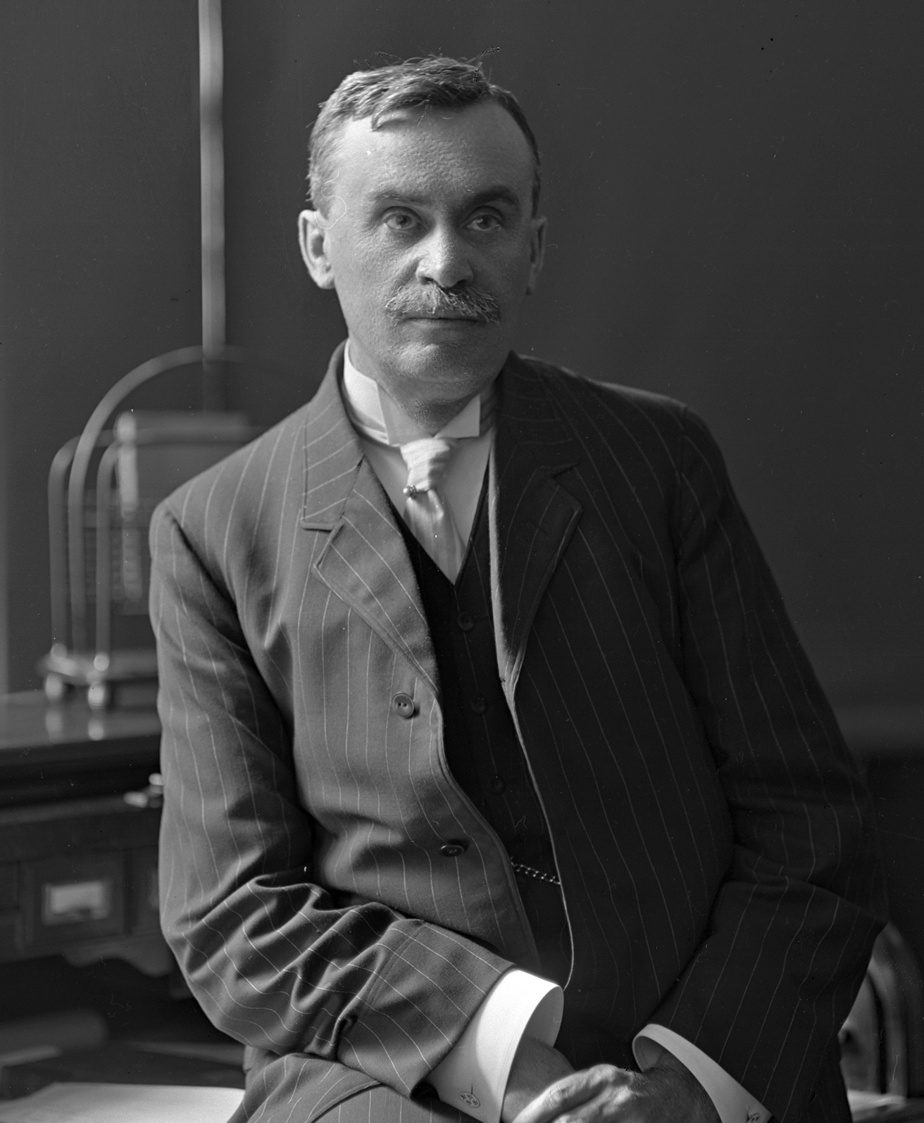

McCord Museum’s photo

Rodolphe Forget in Montreal, circa 1910

its beginnings

Born in Turbonne in 1861, Rudolf Forge is the son of a humble lawyer.

The only boy of six siblings, he attended a trade course at Mason College, which was prematurely stopped by the fires that destroyed the college in 1875.

Barely 15 years old, he began an apprenticeship at the brokerage firm LJ Forget et Compagnie, founded by his uncle Louis Joseph, a Francophone extremely rare in this environment, in 1876.

Madame Francoeur, nicknamed Ernestine Jollet, wrote in her diary published in 1928, recounting her years of experience with Maison Forget: “For 20 years, Maison Forget was the only French-Canadian house in the field.” First and for a long time the only female stenographer in this Anglo-male environment, she was known as Forget madam.

LJ Forget’s clients extended from Gaspésie to Saskatchewan. Even rural people in the Montreal area know the medium. Two “rural customers” once asked, in the heart of Old Montreal, where “the place where we sell stocks of small tanks” was, says Ms. Francoeur.

proofs

Armed with a power of attorney given to him by his uncle while traveling in Europe, Rudolph in his absence made a series of transactions as daring as they were fruitful.

“Aren’t we talking about $40,000 in one go? And more than $80,000 in earnings for his tenure: barely three months?,” says Madame Francoeur.

The young wolf was accepted as a partner in 1890.

“It wasn’t fun, as it was fun for us, to see this young French Canadian […] All his fellow Englishmen lead by finger and eye, and behind them are their distinguished clientele,” adds the shorthand writer.

Because LJ Forget has become the largest brokerage firm in Canada. In 1895, Louis-Joseph and Rudolph between them held 57% of the transactions of the Montreal Stock Exchange, as Christian Harvey points out in his autobiography of Rudolph Forget published in October 2021.

But already, Forgets takes a close interest in managing the companies they invest in, directly or on behalf of their clients.

electrified

As early as 1890, Rodolphe began acquiring shares in the six-year-old Royal Electric Company, which had held the main street lighting contract in Montreal since 1889. In 1899, Forgets and a few colleagues took control of the company that Rudolph was its chief.

This is an opportunity for him to put all his energy into. He had the brilliant idea of merging the Royal Electric Company and the Montreal Gas Company, headed by Herbert Samuel Holt.

Rudolph, with the support of his uncle, succeeded in solidifying the formation of the Montreal Light, Heat and Power Company in 1901, headed by Holt of which he became its second vice president. The Rodolphe Forget establishment would be nationalized in 1944 under the name Hydro-Québec.

pitfalls

In 1894, a group of investors led by Forget took control of the Richelieu and the Ontario Navigation Company, whose steam ships were primarily traveling in St. Lawrence.

To support and expand the company’s tourism activities, Rodolphe expanded his Tadoussac Hotel and in 1899 launched the construction of the Manoir Richelieu.

Photo courtesy of McCord Museum

The original Manoir Richelieu in Pointe-au-Pic, early 20th century

Motivated by the beauty of the area, the financier had a lavish summer residence built in Saint-Irénée in 1901 (it was destroyed, but continues today by the Domaine Forget Musical Academy). He ran in Charlevois for membership in the Conservative Party in 1904.

During his victorious campaign, he pledged to build a railway between Quebec and La Malbay.

The Quebec and Saguenay Railroad, which was to have a capital of one million dollars, was created for this purpose in May 1905.

But the geographical obstacles are significant and the company is struggling to raise capital.

After several refusals, in 1911 he obtained permission from the federal government to establish a Canadian bank backed by French capital, the Canadian International Bank, which invested in the project.

After a successful start, CIB’s momentum was shattered in 1912 by a power struggle between Canadian and French investors, along with a campaign by its political opponents. Afraid, French investors are withdrawing. At the end of 1912, the BIC token was swallowed up by the Home Bank of Canada.

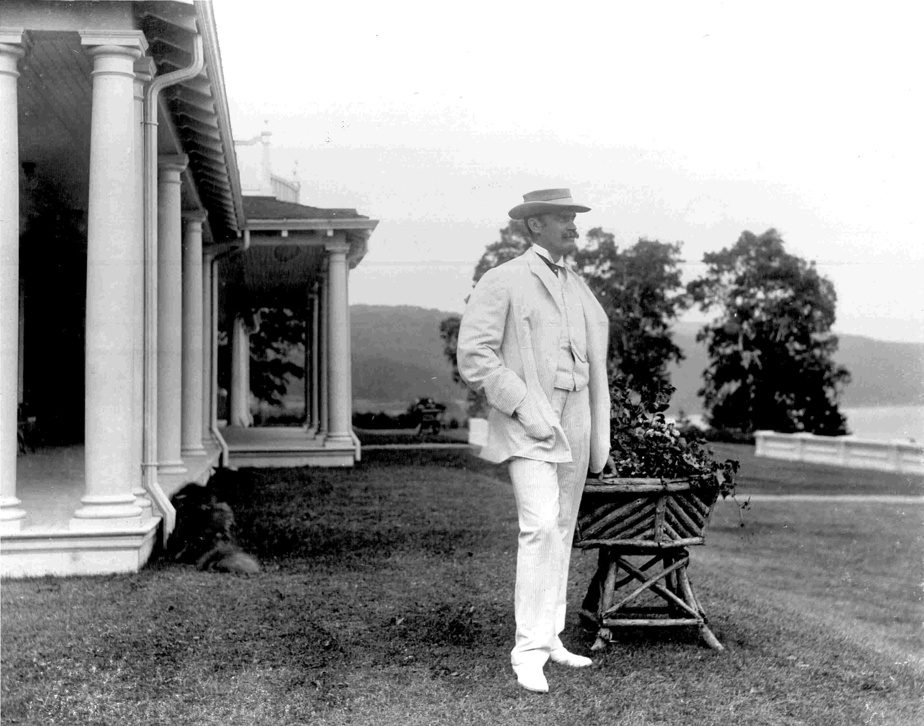

McCord Museum’s photo

Rudolf Forget contemplating the river in front of his summer residence in Saint-Irene, named Gilmont in honor of his son Gilles.

life

Their visions diverged more and more, Rodolphe Forget left his uncle’s company in 1907 and opened his own brokerage firm in Montreal, with a branch in Paris.

Over the years, he has been instrumental in creating or merging several companies, while pursuing a clandestine political career.

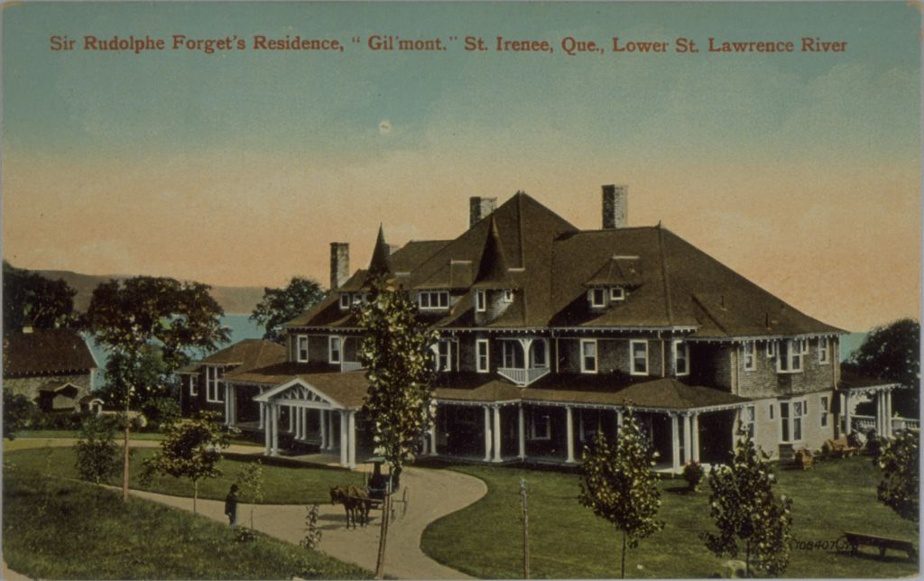

Photo provided by the bank

Rodolphe Forget’s summer residence in Saint-Irénée, now destroyed

As far as funders, Rudolph has charitable spells. He decided to support the rebuilding of Notre Dame Hospital during a field visit. Christian Harvey estimates his donations to the hospital amounted to $400,000 during his lifetime, or more than $6 million in today’s dollars.

This life ended abruptly at the age of 57, on February 19, 1919. He had caught a cold a few weeks earlier while visiting Bay St. Paul.

His daughter, Therese Cassegrain, had an impressive career dedicated to social justice and was the instigator of women’s suffrage in local elections. She said this dynamic of commitment was inspired in her by her father, whom she deeply respected and who “was a huge influence” in her life.

Charlevoix railway was commissioned at 1Verse July 1919. Still in office.

“Subtly charming problem solver. Extreme tv enthusiast. Web scholar. Evil beer expert. Music nerd. Food junkie.”